Stunning growth for crypto ex-BTC in 2021

While Bitcoin, the stalwart of the category, has been making new ATHs, almost two thirds of the growth is coming from the non-store of value platforms, or "Crypto-ex BTC"

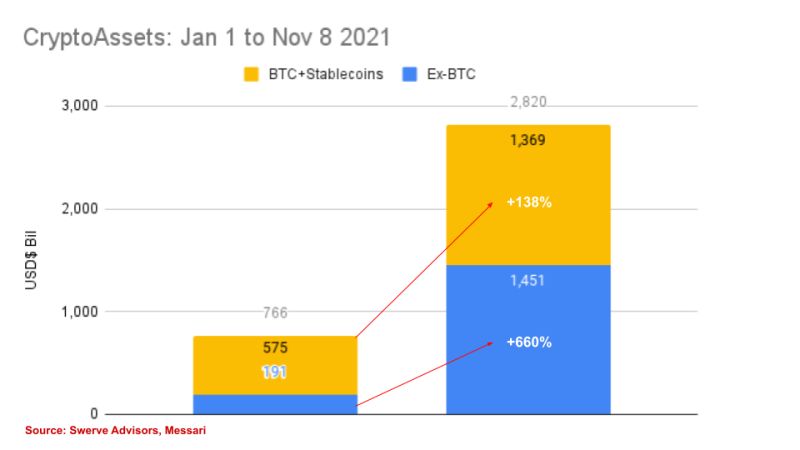

2021 is shaping up as another banner year for crypto assets as their total value shoot up from $766 to $2,820 bil; a 270% increase in less than eleven months. While Bitcoin, the stalwart of the category, has been making new ATHs, almost two thirds of the growth is coming from the non-store of value platforms, or “Crypto-ex BTC” (see chart). These are a panoply of assets that have been built to serve a variety of use cases ranging from smart contracts, financial services, games, cloud computing, logistics, energy etc. The amount of capital flowing into this category is truly astonishing. Just to give an idea, the venture capital flows into blockchain projects this year is larger than the combined total of the previous ten years and it is approaching 10% of total global funding. What is going on here? The vast majority of these platforms have little or no use and are, at best, wildly overvalued. Yet the “smartest” money is accelerating deployment in the category. At least two issues to consider. First off these investments are basically a call option on a future that is looking ever more probable; the rise of decentralized autonomous organizations or “DAOs”. After two decades of living under the hegemony of mega tech companies, there is little appetite for granting these companies more power over people’s lives and data. Hence, at least some of the upcoming “web 3” or “metaverse” is likely to be built on DAOs. The second, and possibly even more compelling reason, is that the allocation of capital to the sector is looking increasingly attractive if compared to traditional asset classes. The investment case for cash and bonds, together accounting for approximately two thirds of global financial assets, has been crippled by the toxic combination of unprecedented sovereign debt and rising inflation. As per equities, more than a decade of extreme monetary stimulus has inflated valuations and destroyed price discovery. It is no wonder that crypto assets are attracting more and more capital. There are reasons to believe the trend may continue as traditional asset classes get even more dysfunctional and the migration away from them accelerates. Even assuming only 2% of the approximately $770 trillion in total global assets flows into crypto ex-BTC between now and the end of the decade, the category would go from this year’s $1,450, to $15,000 bil; a 10x+ growth. To quote Ark’s Cathie Wood: “The future of investing is investing in the future”

Disclosure: Hold all assets mentioned. Not investment advice. Do your own research