Central bankers facing a dire dilemma

The fate of equity markets rest in the hands of the central bankers and they are facing a dire dilemma. Inflation is not so temporary after all and they need to take action.

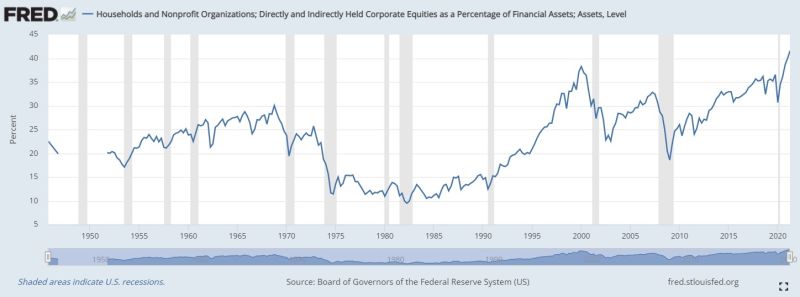

The fate of equity markets rest in the hands of the central bankers and they are facing a dire dilemma. Inflation is not so temporary after all and they need to take action. If they remove liquidity, they may contain inflation but will damage the weak economy. If they stay the course they may keep the economy running but inflation may get out of control. A major compounding factor is that removing liquidity will tank asset prices; just see what a few words from Fed chair Powell did last week. The last 12 months saw an unprecedented amount of funds flowing into stocks as the combination of cheap money and the lack of other good investment options set the stage of an unstoppable rally. Valuations, already toppish before C19, have reached ever more elevated levels with the Cyclically Adjusted PE Ratio (“CAPE”) at 38.3, more than double the 16.7 long term average. Such valuations are predicated on abundant liquidity fueling both share buybacks and retail inflows. Equities represent more than 40% of household wealth, the highest ever (see chart). Any tightening will trigger a negative wealth effect and dampen the already weak economic momentum. Lastly, there is the issue of the gargantuan stock of debt, much of it sitting on the government’s balance sheet. Deficit spending is here to stay and it is hard to see how that would be compatible with higher rates while, conversely, keeping the cost of money at negative real levels alleviate the debt problem. On balance, history, behavioral economics and political game theory, suggest a scenario where policymakers may allege to withdraw liquidity and then, in the face of declining markets and deteriorating economic data, revert course as they have done so many times in the past decade. Investors should not however be too complacent as the liquidity party will not go on forever. This time inflation is the key issue and should CPI continue to rise (double digit?), participants’ psychology may trigger a dangerous spiral. At that point policymakers will have no other option but to push the panic button and deploy new and unorthodox tools such as CBDCs and extreme fiscal policies. Such a scenario would not be good for asset classes of any kind. In the new age sovereign risk is becoming the first principle for the protection of wealth and cognizant investors may want to plan accordingly.