The most used crypto asset is neither Bitcoin or Ethereum

Stablecoins ("SC"), a digital version of the USD on an encrypted decentralized ledger. The success of these digital assets is truly stunning.

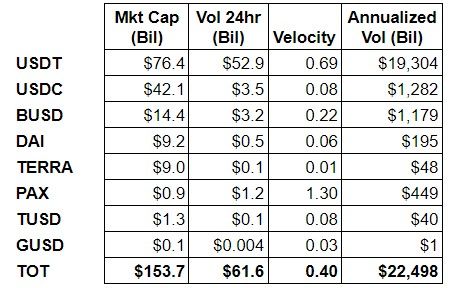

The most used crypto asset is neither Bitcoin or Ethereum, they are Stablecoins (“SC”), e.g. a digital version of the USD on an encrypted decentralized ledger. The success of these digital assets is truly stunning, since my previous post just six months ago (https://lnkd.in/gSvqqHhD) the amount of SC in circulation has more than tripled from $51 to $158 bil. What is truly shocking however is their velocity, i.e. the amount of daily traded volume relative to their total quantity. Yesterday only the top eight SC accounting for 98% of total, had a daily transaction volume of $62 bil; roughly a 40% turn over. In other words, SC are by far the most intensely used means of payment on the planet. Why? Simply put, they are a far superior form of money; they are stable, transaction costs are immaterial, settlement is final (no custodian/counterparty risk), transactions are super fast, borderless and censorship resistant. Most importantly the underlying technology enables financial transactions that generate significant utility and yield for participants. The US government has been very suspicious of these instruments to put it mildly, yet something may be changing. Over the last couple of weeks a number of congressional hearings on the topic attended by some of the top executives in the space, registered a bipartisan shift from hostility to interest. As China is deploying the digital RMB (DCEP) in a few months, it is no mystery that DCEP may go a long way to promote the international use of the RMB at the expense of the USD and the clock is ticking for the US to come up with a counter-move. A “FedCoin”, may be politically very complicated, if possible at all. The notion of US policymakers embracing SC as a way to extend the life of the USD as the global reserve currency is clearly an option. Moreover the extreme velocity enabled by those instruments may also prove a boon to support economic growth. That may require significant regulation for these instruments, but if SC become an accepted part of the global financial system it is likely their adoption will accelerate globally, possibly putting out of business scores of national currencies. After all, once participants realize they can access 5-10% yield using SC, the incentive will be phenomenal.

Disclosure: Hold all assets mentioned. Not investment advice. Do your own research