Bitcoin & Crypto; a forecast for 2022

As one of the few assets that may effectively hedge against the demise of the current fiat monetary system, the investment case for BTC is fundamentally macro-based.

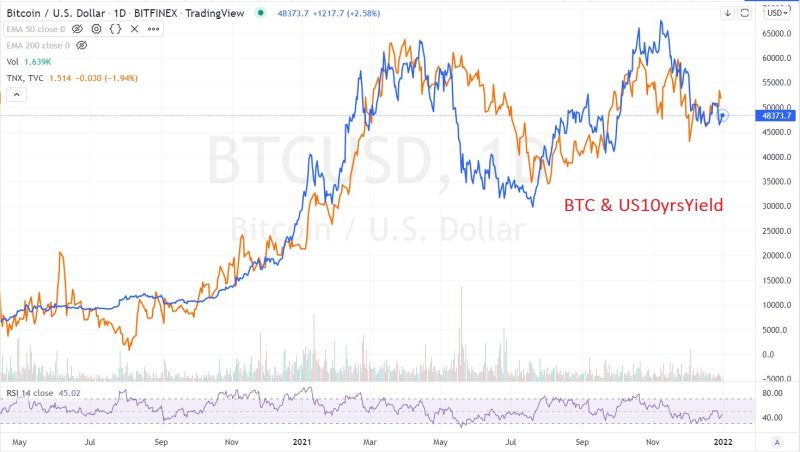

Bitcoin & Crypto; a forecast for 2022. As one of the few assets that may effectively hedge against the demise of the current fiat monetary system, the investment case for BTC is fundamentally macro-based. In fact, since the acceleration of institutional adoption 18 months ago, BTC has been trading broadly in sync with the 10 yrs US Treasury, the pre-eminent macro asset (see chart). As 2022 is shaping up to be a challenging year from a macro standpoint, all asset classes including BTC will face some headwinds. First off, the massive fiscal spending associated with C19 is weaning and de-facto reducing liquidity in the system. From a monetary policy standpoint, the rise of inflation has put central bankers in a bind: withdrawing liquidity to tame prices or keeping the liquidity flowing to protect the economy and asset markets. History and political game theory suggest they may choose to stamp out inflation as a politically more dangerous threat than declining asset prices. If such analysis is correct, BTC will have a bumpy year ahead, likely not conducive to the kind of momentum that would be necessary to break the psychologically significant $100k mark. As per crypto ex-BTC, on a very basic level, they have an elevated beta vs BTC, hence if BTC’s sneezes, the rest of the asset class typically catches a cold. Furthermore, we are likely to see at least some regulatory action dampening enthusiasm in sectors such as DeFi and NFTs. Overall 2022 will see the start of a shake-out phase of the “S ” curve with scores of tokens collapsing and a relative few outperforming, akin to the 2000-2002 period for web2 technology companies. Make no mistakes however, there is no stopping the rise of decentralization in society and the economy. The longer term game is still looking overwhelmingly attractive for both BTC & selected blockchain use cases. To put it as Paul Tudor Jones: the most successful investors are those whose own time horizon matches their investment time horizon.

Disclosure: Hold all assets mentioned. Not investment advice. Do your own research