“Smart” money piling up into Venture Capital

As the future returns of cash, bonds and equities are looking increasingly dubious, institutions and HNWIs are betting that earlier stage investment into technology is holding the key to a more attractive outcome.

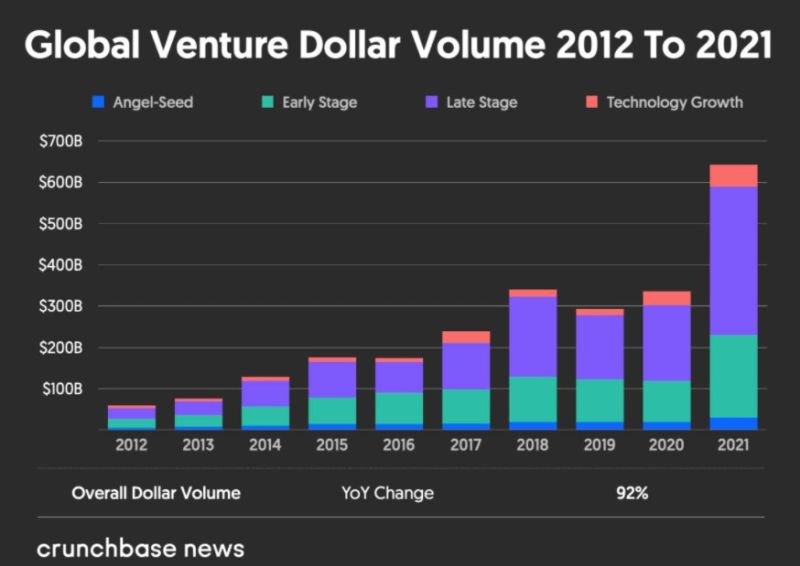

The “smart” money has been piling up into Venture Capital (“VC”) last year. Total flow for 2021 was $643 bil, a stunning 2x of the flows in each of the three last years (see chart). As the future returns of cash, bonds and equities are looking increasingly dubious, institutions and HNWIs are betting that earlier stage investment into technology is holding the key to a more attractive outcome. Problem is that, for most investors, VC is fraught with two major issues. First and foremost “Access”. Returns are massively concentrated as most early stage companies fail and only very few generate positive payouts. Looking at the 2010-2019 data, the average VC returns are only 0.3% higher than the S&P 500 as the bulk of the performance is concentrated in the top quartile. Accessing the more attractive VC opportunities has become virtually impossible for all but a few top players, especially as more capital is pouring into the asset class. Should flows continue to grow, it is likely that future returns from VC will be even more dispersed. Liquidity is the second issue as the investment is typically locked in for 5-7 years until a liquidity event (if any) starts to return capital to investors. Most investors can therefore only allocate to VC relatively small parts of their portfolio hence lacking critical mass to enter the asset class. Both issues of “access” and “liquidity” are somewhat mitigated when it comes to investment into blockchain assets. That is why the category has been, in relative terms, the true winner in 2021 garnering a shocking 6% of total flows; more than the cumulative VC investment in the space EVER. Such capital is deployed more and more through token purchases and, for those who know what they are doing, the access to such assets is reasonably easy as the teams behind the project would typically aim to make them available as widely as possible to drive adoption. Moreover tokens tend to be extremely liquid as they trade 24/7 on a variety of platforms globally. That explains why VC giant a16z have tripled their investment in the space and Sequoia has created an ad hoc team only focused on crypto. Granted VC investing, including crypto ex-BTC, is very risky and should be carried out only within a well-diversified portfolio, there is no question that the future of investing is investing in the future.

Disclosure: Hold all assets mentioned. Not investment advice. Do your own research