Property & equities at times of inflation

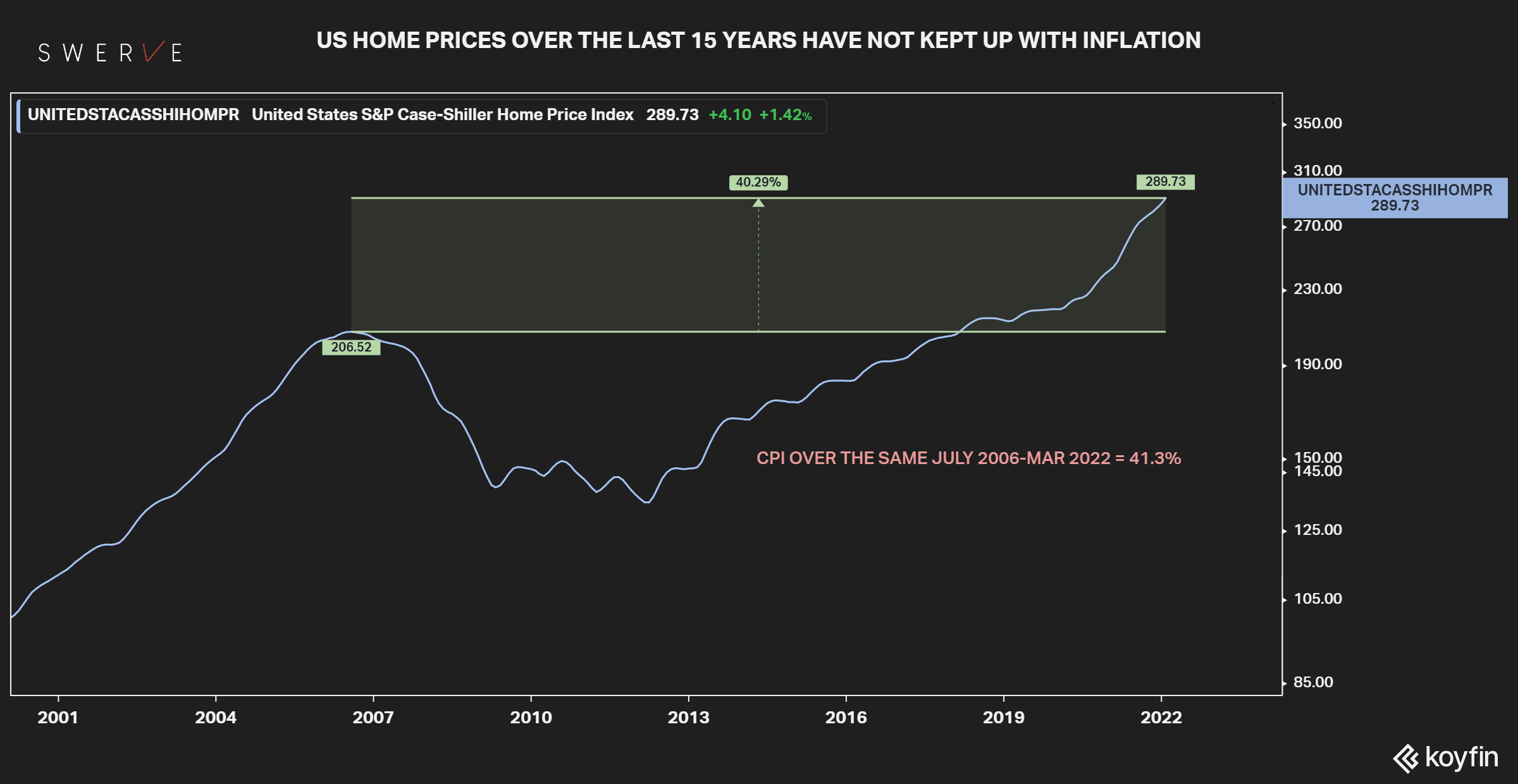

Conventional wisdom has it that property and equities are good inflation hedges. Data show otherwise. Let's take property; in the last 15 years since the 2007 top, US residential market prices have increased 40% and failed to offset the 41.3% inflation over the same timeframe.

Conventional wisdom has it that property and equities are good inflation hedges. Data show otherwise. Let’s take property; in the last 15 years since the 2007 top, US residential market prices have increased 40% and failed to offset the 41.3% inflation over the same timeframe (see chart). Data gets even worse if the returns are measured during inflationary periods. A recent Duke University study (https://lnkd.in/gPF-zXeC), measured the real returns of a number of asset classes during eight inflationary regimes from 1926 to 2020 in US, UK & Japan. The results show that property’s annual real returns were negative (- 2%) during years of inflation and easily beaten by inflation-linked bonds (+2%). Equities’ performance was even worse with a 7% loss on a real return basis and significant variance across sectors. Best performing assets? Not surprisingly energy, industrial metals and gold. As opined before on these posts (https://lnkd.in/gUu7Tt73), stagflationary conditions will be a hallmark of this decade and astute investors may want to check their recency bias and embrace the need to change course. It is time to Swerve. (Disclosure: Hold all assets mentioned. Not investment advice. Do your own research)