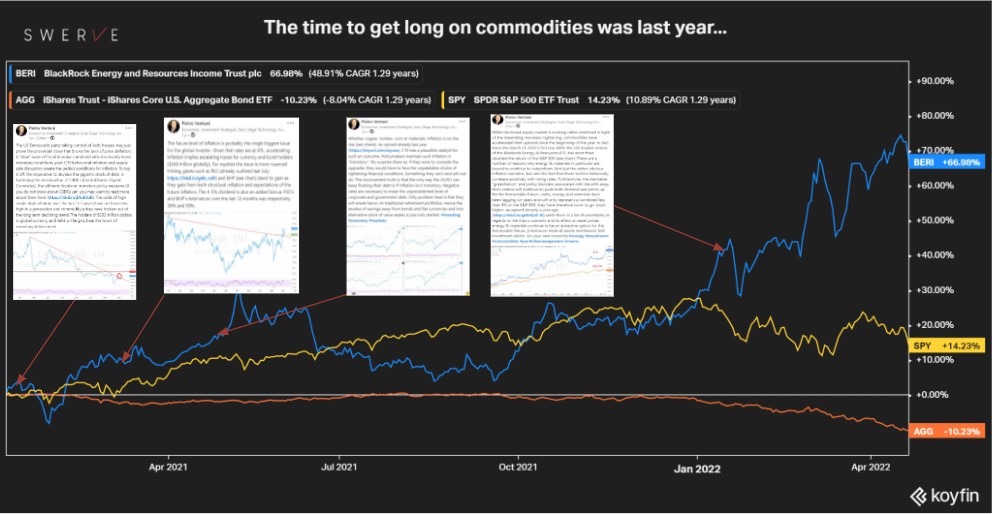

The time to invest in commodities was last year

Over the last few weeks virtually every investment house has jumped on the commodity bandwagon. The Ukraine war and persistent inflation have brought to the forefront what has been for years one of the most underinvested themes. Yet, as opined several times on these posts, the time to deploy capital was last year as a combination of obdurate inflation, ESG and geopolitics were already arguing a strong case for energy and materials.

Over the last few weeks virtually every investment house has jumped on the commodity bandwagon. The Ukraine war and persistent inflation have brought to the forefront what has been for years one of the most underinvested themes. Yet, as opined several times on these posts, the time to deploy capital was last year as a combination of obdurate inflation, ESG and geopolitics were already arguing a strong case for energy and materials. Since my January 7, 2020 post (https://lnkd.in/g44YNbhz) as shown by BERI, the LSE-listed Blackrock energy & resources ETF, commodities have had a 67% run up massively outperforming both key equities and bonds benchmarks (see chart). The case for a well-thought position in the commodity space still holds but the gains over the next few years may be less extravagant for the overall sector than the past with specific verticals likely to outperform. Timing in investing, as in life, often makes a big difference and, in the current liminal phase for the economy and global markets, the ability to frontrun major macro turning points makes all the difference. (Disclosure: Hold all assets mentioned. Not investment advice. Do your own research)