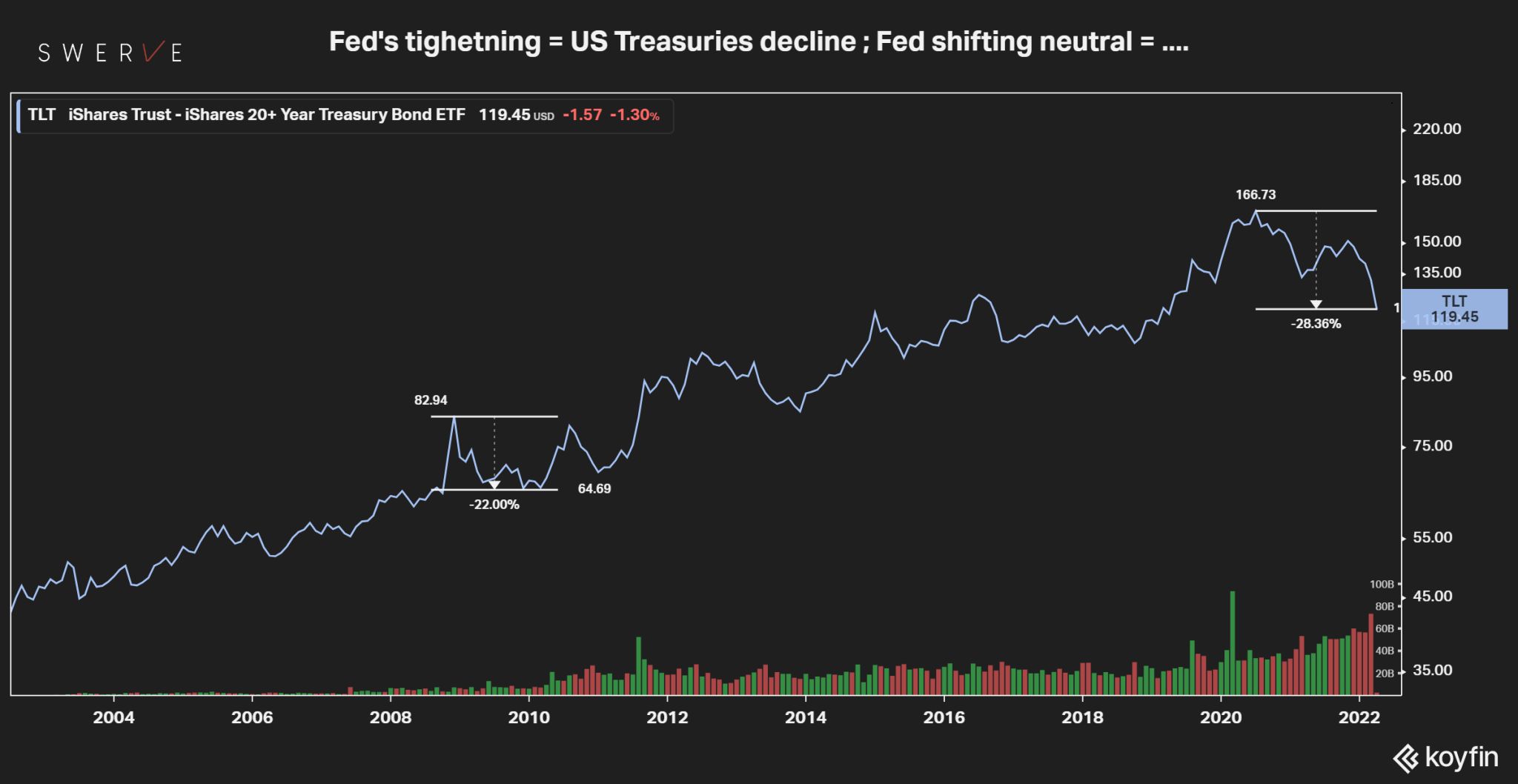

Long duration treasuries are poised to rally should the Fed go neutral sooner than the market expected

Should the economy continue to weaken, the Fed may decide to stop far sooner than the ~ 2.5% in fed funds rate that the credit market is pricing in. Some deceleration in CPI would also provide additional cover. Should policymakers tilt dovish, we will see an impressive rally in US treasuries, especially on the long end of the yield that has experienced one of the worst, and fastest, declines on record.

In a stunning turn of events, the US Gdp belied expectations and came in negative relative to the previous quarter. The data rather complicates the job of the Fed as strong inflation trends interlace with a weakening economy. The prospects of stagflations have been growing for months as a decade of growing debt translated into zombified economies, the base effect from last years massive stimulus and geopolitics prevent the economy from reaching escape velocity (see Aug 2021 post here: https://lnkd.in/gzx3gDBg). Should the economy continue to weaken, the Fed may decide to stop far sooner than the ~ 2.5% in fed funds rate that the credit market is pricing in. Some deceleration in CPI would also provide additional cover. Should policymakers tilt dovish, we will see an impressive rally in US treasuries, especially on the long end of the yield that has experienced one of the worst, and fastest, declines on record (see chart). As per equities, beside some relief rally in long duration (e.g. FANGS), the response may be more muted as stagflation makes for a challenging environment for earnings. More importantly, a Fed’s dovish tilt would likely further entrench inflation and provide an evermore fundamental tailwind for gold and BTC. The former will be buoyed by real rates and the greenback resuming their decline. The latter as the headwinds of the “tightening put” fade out and prices go higher because of the inevitable growth in global adoption. As opined in the past on these posts; history, context and political game theory all but assure the Fed will stop short of beating inflation into submission. Hence there is no “going back to 2019” as most of the traditional asset classes, albeit getting a break in nominal terms, will continue to leak value in real terms for years as past and future stock of debt will need to be devalued away. (Disclosure: Hold all assets mentioned. Not investment advice. Do your own research)