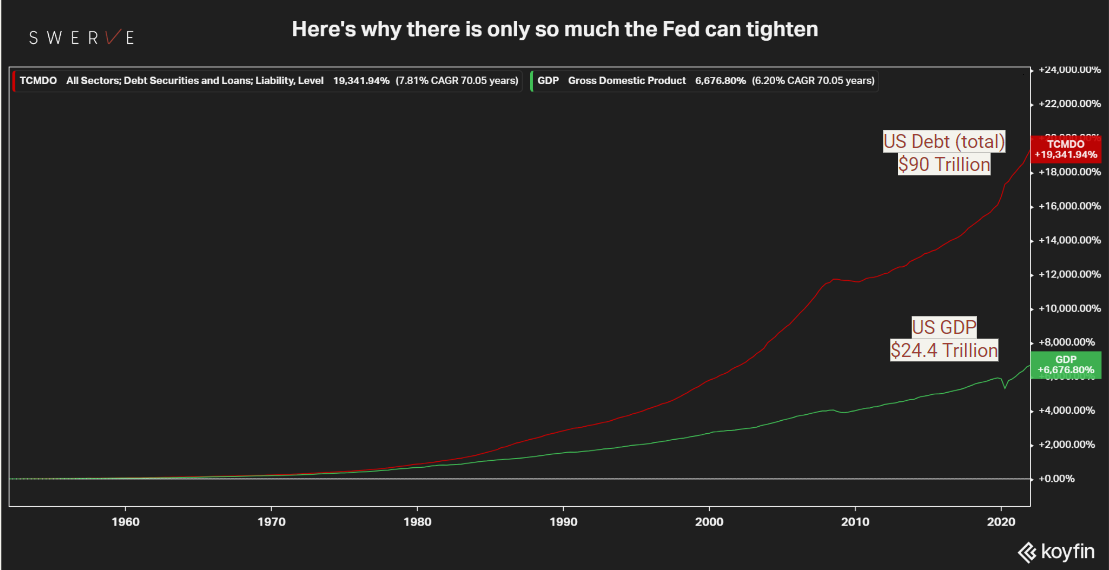

Here’s why there is only so much the Fed can tighten

"How far can the Fed go into tightening financial conditions?" is the #1 question for global investors today and some "First Principle" thinking may be useful to address it.

“How far can the Fed go into tightening financial conditions?” is the #1 question for global investors today and some “First Principle” thinking may be useful to address it.

For decades debt and the economy grew at a roughly comparable rate. That changed in 1971 when Nixon closed the gold window and ushered the global “fiat” currency era. #debt became untethered from the real economy and in 70 years the total US debt to GDP ratio went from 1.2x to 3.7x (see chart). Put it bluntly, there has never been so much debt in the US and globally.

Consensus has it that the end of the tightening will be a function of economic slowdown and declining CPI. It may not work that way. Given the amount of debt in the system, the risk of a systemic credit event is increasing and may force the Fed to relinquish and, possibly, even reverse action. As liquidity dries up, the signs of distress in the credit markets are starting to show. The MOVE index, the “fear” index for bonds, for example, has broken out of its long term trend and it is at the highest level in a decade. On the same token, mortgage rates, the bell weather for the all important housing sector, doubled in 12 months and home sales data have started to deteriorate. In other words, elevated debt greatly constrains the ability of the Fed to withdraw liquidity and they may need to tilt to “neutral” before #inflation is brought under control.

Such an outcome would ensure that rising prices become entrenched for years to come as some key disinflationary drivers of the past, globalization and “free” money are both reversed. It is historically inevitable that yet another age of debt will end up in currency debasement. The implications for investors are profound. On a very basic level, #portfolios need to shift from “fiat” to “real” assets whose scarcity is verified and can ensure a modicum of capital protection and real returns. Likewise, the management of #sovereignrisk also becomes a key factor in wealth protection and risk adjusted returns. “No Toto, we’re not in Kansas anymore”. Disclosure: Hold all assets mentioned. Not investment advice. Do your own research.

#economy #markets #globalization #investing