Stagflation is upon us

#raydalio is the founder of Bridgewater, one of the largest and most successful hedge funds. He recently wrote a piece maintaining that #stagflation is upon us. The signs pointing to such an outcome have been visible for at least a year.

#raydalio is the founder of Bridgewater, one of the largest and most successful hedge funds. He recently wrote a piece maintaining that #stagflation is upon us. The signs pointing to such an outcome have been visible for at least a year as I have often opined on this platform. On a very basic level, the large stock of #debt in the system and the reaction function of policymakers in the major economies, created a series of predictable path dependencies leading to inflation first (see my May2020:https://lnkd.in/dw4s8_Z8) and stagflation after ( see my Aug2021:https://lnkd.in/d9m_9ZbZ).

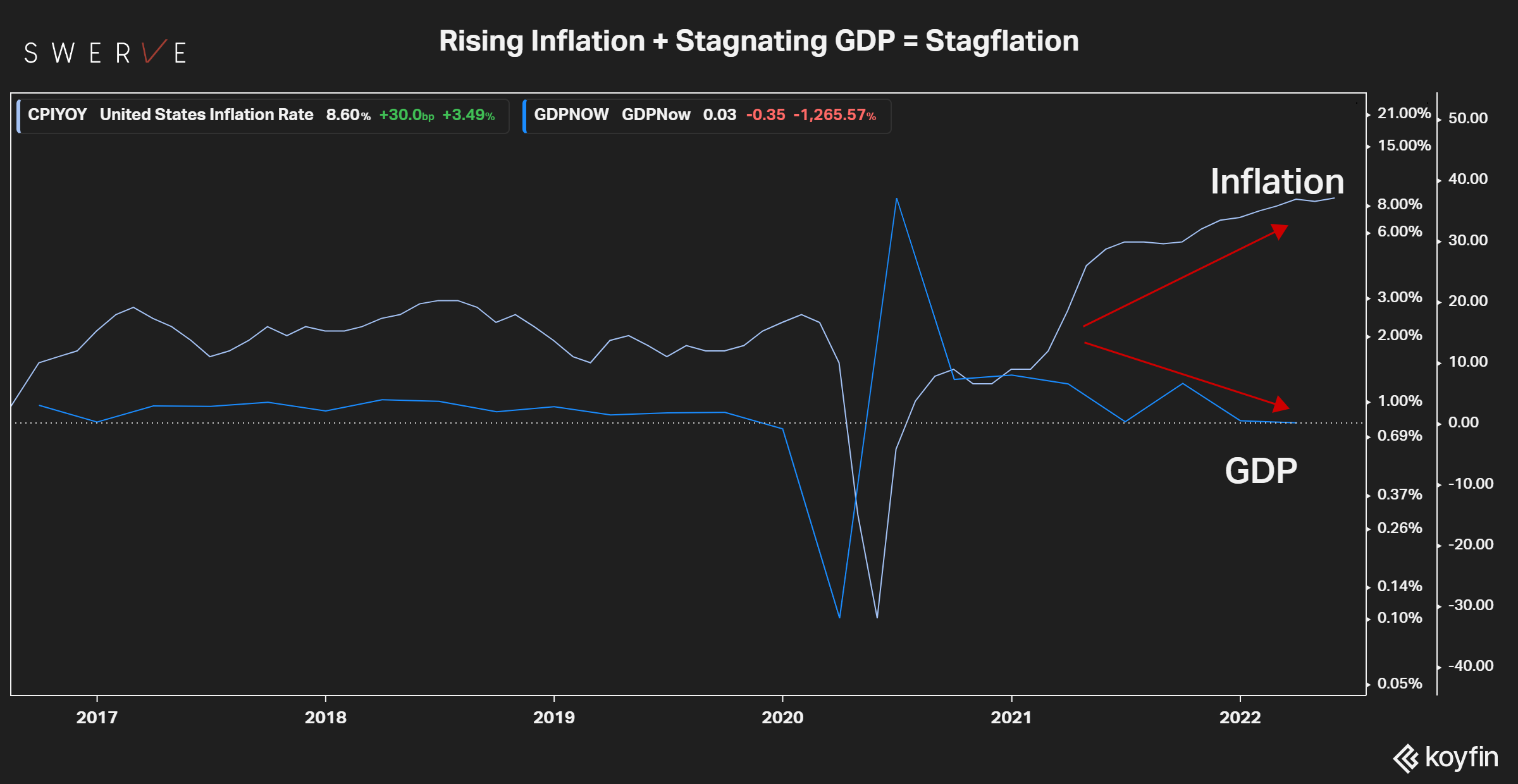

Years of misguided pseudo-Keynesian thinking and, more recently due to C19, Modern Monetary Theory (“#mmt“) engendered the impression that debt doesn’t matter. The truth could not be more different as a large stock of debt constrains monetary policy and the ability to fight inflation on one side, while structurally impairing economic growth and, therefore, prompting ever larger sovereign fiscal deficits on the other. The inevitable end result is, precisely, stagflation (see chart).

Such conditions are likely to persist until one of the two following scenarios play out: either the stock of debt is debased in real terms enough for economic growth to reach “escape velocity”, or some external event reset the economy and reboot the system altogether. As elucidated by Ray Dalio in his “Changing World Order” essay, historical evidence points to the latter rather than the former as the more common outcome. The reason for the “reset” scenario to be more frequent is that rising prices and stagnating growth are typically associated with heightened political and geopolitical instability.

Global investors need to rethink their allocation strategy along the lines of real assets, pricing power and the management of “tail” sovereign risk. #energy, #materials and #storeofvalue which reduce/eliminate counterparty risk appear most suitable together with a thoughtful assessment about the sovereign risk associated with the jurisdiction where the investor and/or the assets are located. Disclosure: Hold all assets mentioned. Not investment advice. Do your own research.