Deglobalization drives Inflation (and viceversa)

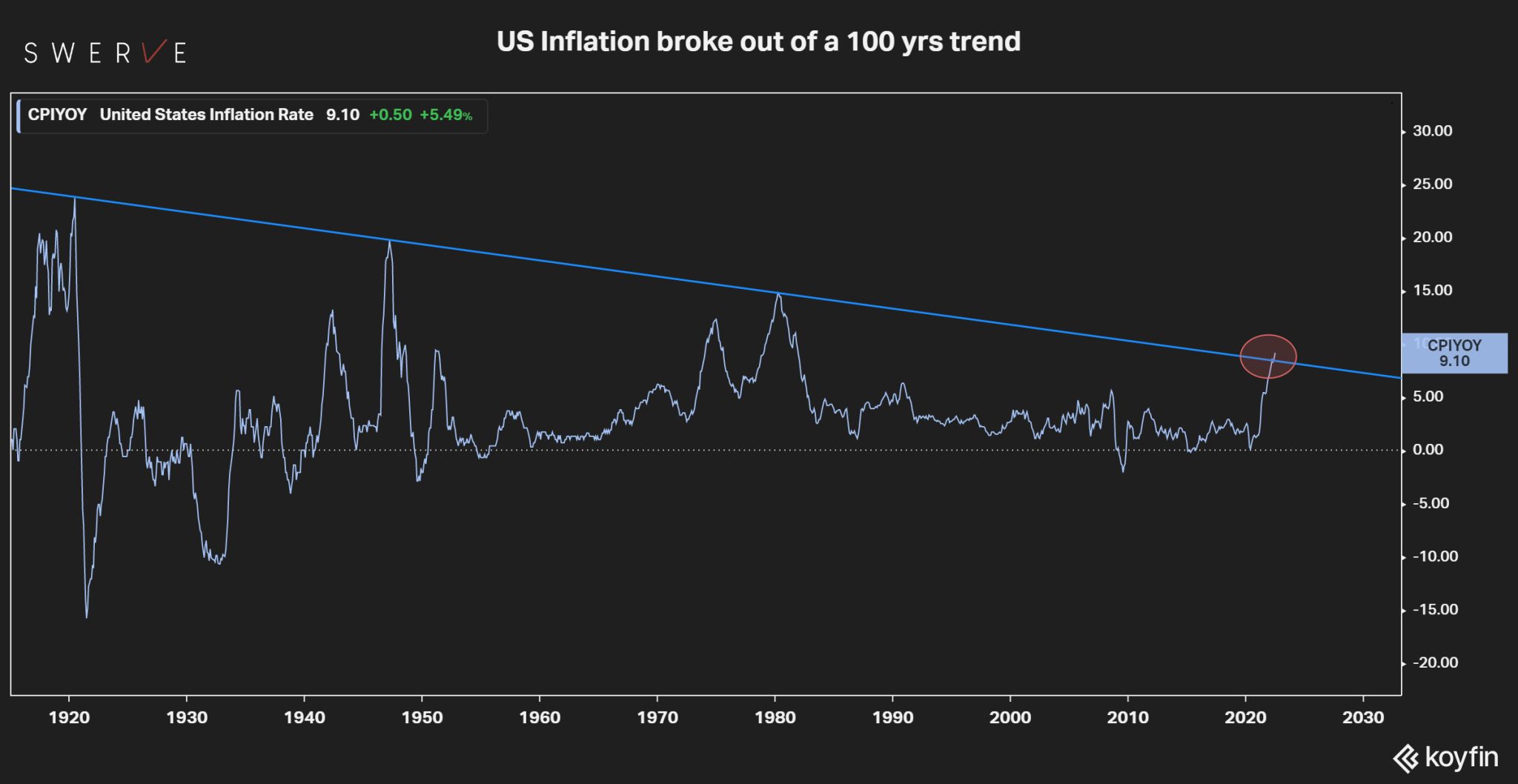

The future level of #inflation is a key variable for asset prices and many analysts believe the current elevated reading will be short-lived. The CPI chart tells another story as the descending long-term trend has been violated as the US and most other economies are facing the worst inflation since the 1980s. The drift toward #deglobalization may help to explain what's ahead.

The future level of #inflation is a key variable for asset prices and many analysts believe the current elevated reading will be short-lived. The typical argument is that, because of technological innovation and demographics, price increases will soon revert to the 2-2.5% that has been the norm for the last 20 yrs. The CPI chart tells another story as the descending long-term trend has been violated (see chart) as the US and most other economies are facing the worst inflation since the 1980s. The drift toward #deglobalization may help to explain what’s ahead.

For decades, the world economy has enjoyed unfettered trade and circulation of people, ideas and capital. That regime has reversed as political and geopolitical circumstances are prompting nations to raise barriers not just to commerce but also to ideas and investment. History shows that the reversal of #globalization is profoundly inflationary. The correlation between globalization (defined as the increased flow of capital, goods, and people) and lower prices is intuitive as the latter generates consistent downward pressure on wages and goods & services. The opposite is also true as a less globalized world is inherently more inflationary.

We have observed the link between inflation and globalization before. The best historical analogue for the current phase is provided by the 1840-1914 timeframe. Also at that time, as today, international trade flourished and there was unprecedented freedom of circulation for ideas and capital. In those years, global trade to Gdp reached levels that would not be observed again until the 1970s.

Globalization cycles are typically composed of four stages: “disruption”, “reform”, “innovation” and “opening”. Our current globalization phase is a byproduct of the 1960-70s when the Vietnam war, the end of the gold standard and major supply shocks, triggered a severe inflationary phase. That gave way eventually to political reform (e.g. Russia & China) that, together with major technological innovation, spearheaded globalization. The latter came to an end with the rise of populism in the late 2010s, C19 and the Ukraine crisis and a new inflationary regime.

The shift to higher inflation conditions carries colossal implications. Rising prices aggravate, by definition, scarcity and asymmetries of supply in key markets such as food and energy. Inflation is politically toxic and the typical reaction function from policymakers is to try and control prices. Such a response typically worsen the problem and aggravates scarcity and inequality. Those outcomes, in turn, elevate political and geopolitical conflict in a cycle of ever growing scarcity and conflict until a new round of reform and innovation kick-off a new era of globalization. Until then, the key learning for investors is that a major adjustment is in order as we enter an age where “scarce” assets will outperform and sovereign risk is no longer “tail” but moves squarely at the center of the distribution curve.