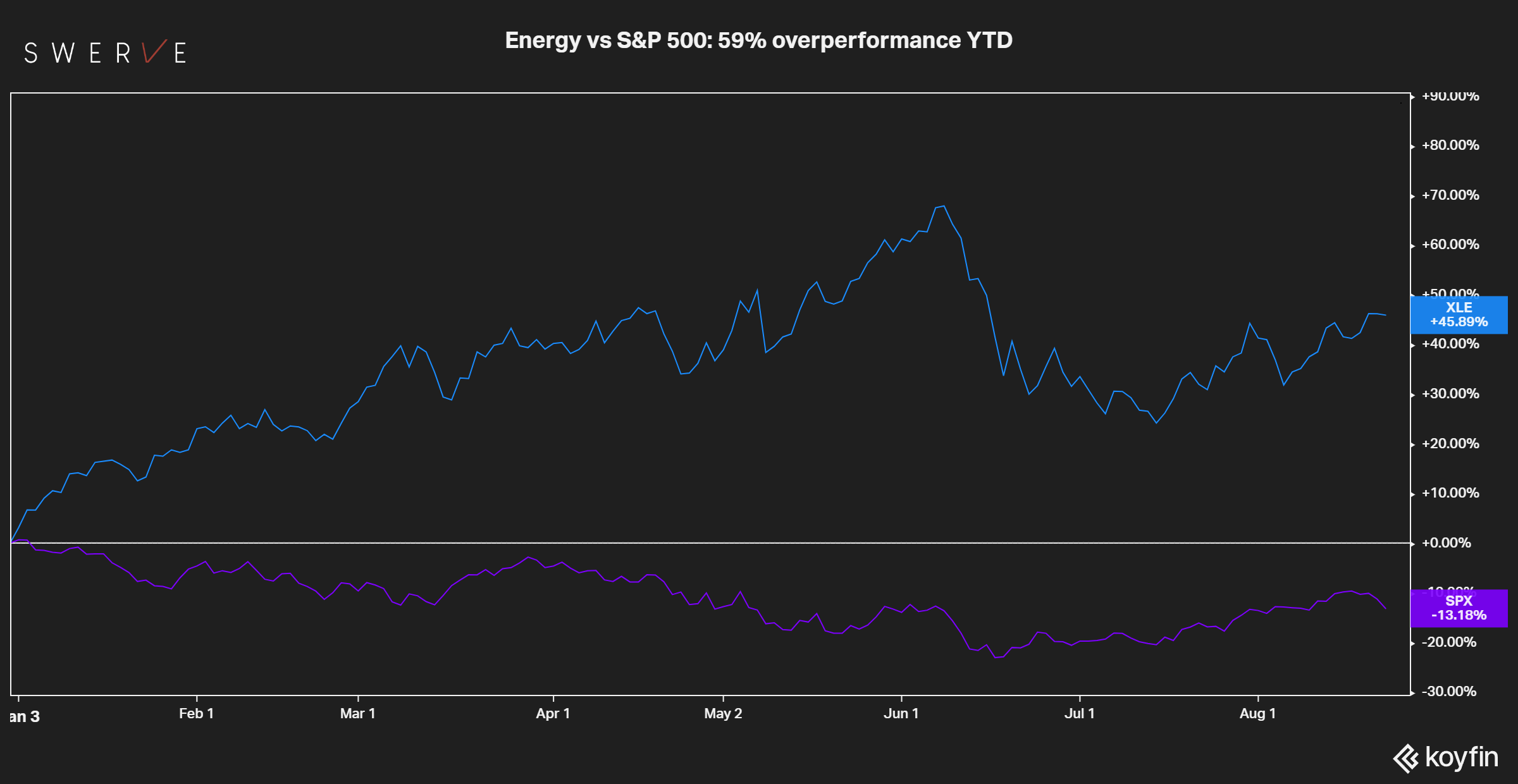

Energy is on a roll and yet investors seem to have hardly noticed

After four decades #energy is squarely back at the center of the economic, financial and political discourse. Yet investors seem to have hardly noticed. Even after a spectacular performance YTD, the energy sector is still a meager 4.2% of the total market capitalization and 40% below its 20 years average.