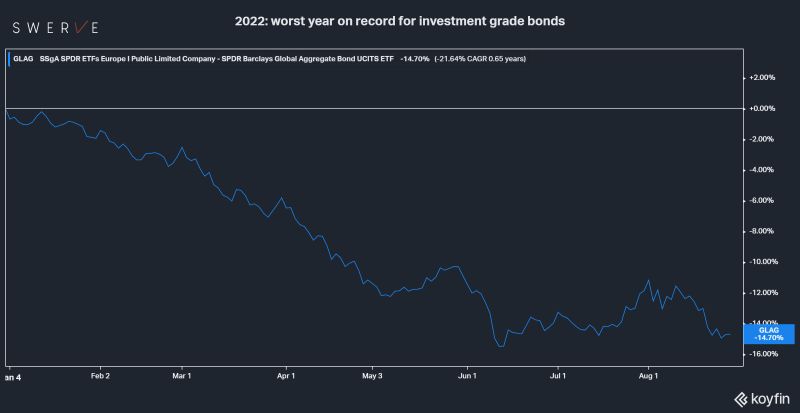

2022 YTD is the worst year on record for investment grade bonds

2022 has been an excruciating year for bond investors. The Bloomberg Global Debt Index, one of the widest measures for the $61 trillion global investment grade bond market, is down 14.7% YTD. It is the worst performance since its inception in 1990. Bonds, traditionally the mainstay for insurance companies and retirees, are considered a safer and less volatile asset class and are not supposed to decline this much this fast. What gives?

2022 has been an excruciating year for #bond investors. The Bloomberg Global Debt Index, one of the widest measures for the $61 trillion global investment grade #bondmarket , is down 14.7% YTD (see chart). It is the worst performance since its inception in 1990. Bonds, traditionally the mainstay for insurance companies and retirees, are considered a safer and less volatile asset class and are not supposed to decline this much this fast. What gives?

On a very basic level, the conditions that drove the bond bull market for the last forty years are in reverse. We have entered a phase of #deglobalization and the new regime, combined with aging demographics and the highest level of global debt ever recorded, has triggered persistent #inflation . The latter is politically toxic and, after some considerable delay, central banks have started to tighten financial conditions and reduce liquidity.

It is a major shift in the kind of stimulative policies that have been the hallmark of the last 15 years and guaranteed a predictable stream of capital gains for bond holders. Furthermore, a combination of geopolitical factors, supply side issues and climate change emergencies are likely to prompt fiscally expansive policies, hence forcing central banks to keep tightening or, at best, to maintain a neutral position (think: yield curve control) so to prevent inflation from reaching escape velocity. In plain English: the losses accrued are permanent and negative returns in real terms are likely to continue.

Rates will continue to rise and eventually stabilize at significantly higher levels vs historical. Hence at best negating any return on the capital account and, at worst, continuing to generate losses. On the interest account, rates are in the low single digit and evidently insufficient to compensate for the current and future level of inflation. The investment case for fixed income appears dubious for the foreseeable future except perhaps for limited allocation as a cash alternative and strictly limited to selected very liquid, inflation-linked, short duration instruments. Disclosure: Hold all assets mentioned. Not investment advice. Do your own research.