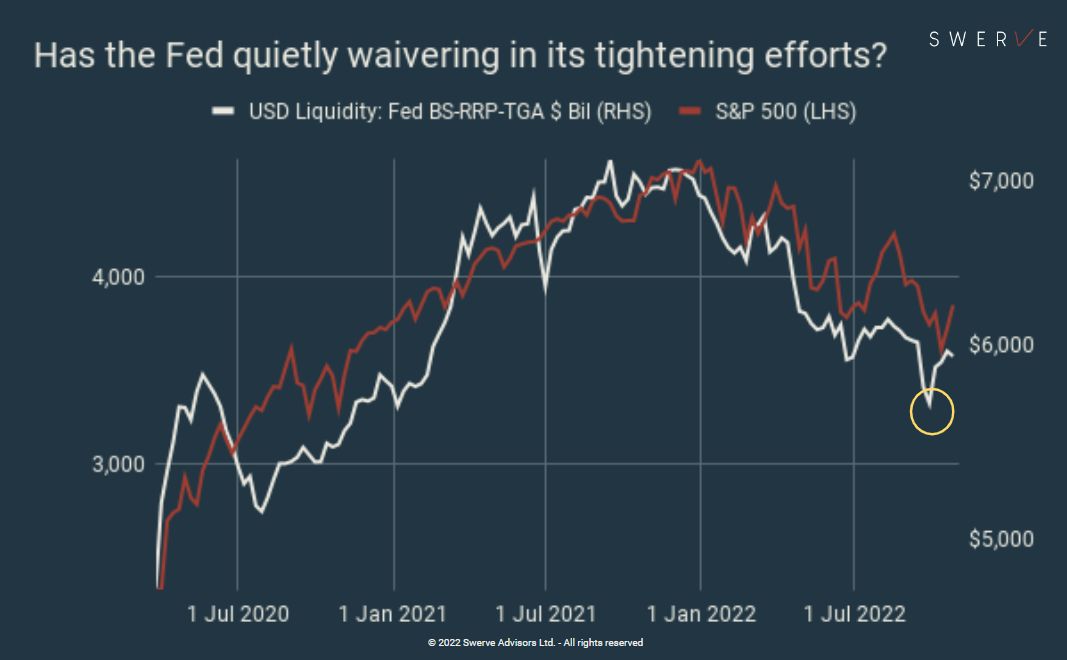

Is the Federal Reserve quietly waivering in its tightening efforts?

Is the #federalreserve quietly waivering in its tightening efforts? This is not a trivial matter as #usd liquidity has been for years the key factor driving asset prices.

Over the last four weeks USD liquidity, defined as the aggregate of Fed’s balance sheet, Reverse Repo and Treasury’s General Account variations, has actually increased. The rebound is largely due to the reduction in the Reverse Repo balance, operations deployed by the Fed to drain liquidity from the banking system. The lowest level in the indicator was Sep 28th, not coincidentally also the date that marked the recent peak for the USD index “DXY”. Since that date liquidity increased, albeit moderately, and equities have rallied accordingly (see chart).

It is too early to point to a change of Fed’s policy. It is possible however that the central bank started to get worried about financial stability both domestically and internationally and decided to take the foot off the pedal, at least temporarily. The implications of a pause in Fed’s tightening efforts are significant. It would on one side provide support to asset prices but, on the other side, further anchor inflationary pressure.

Whether the Fed stands by or perseveres, the only certainty for investors is that there’s no going back to the 2010s. The four “Ds” of Debt, Deglobalization, Demography and Decarbonization designate a macro backdrop that is profoundly different from the past. Persistent inflation, elevated sovereign risk and wide dispersion of returns across asset classes require an entirely different approach to wealth management. Beware of recency bias.

Disclosure: Hold all assets mentioned. Not investment advice. Do your own research. Twitter @pietroventani for more timely comments and updates