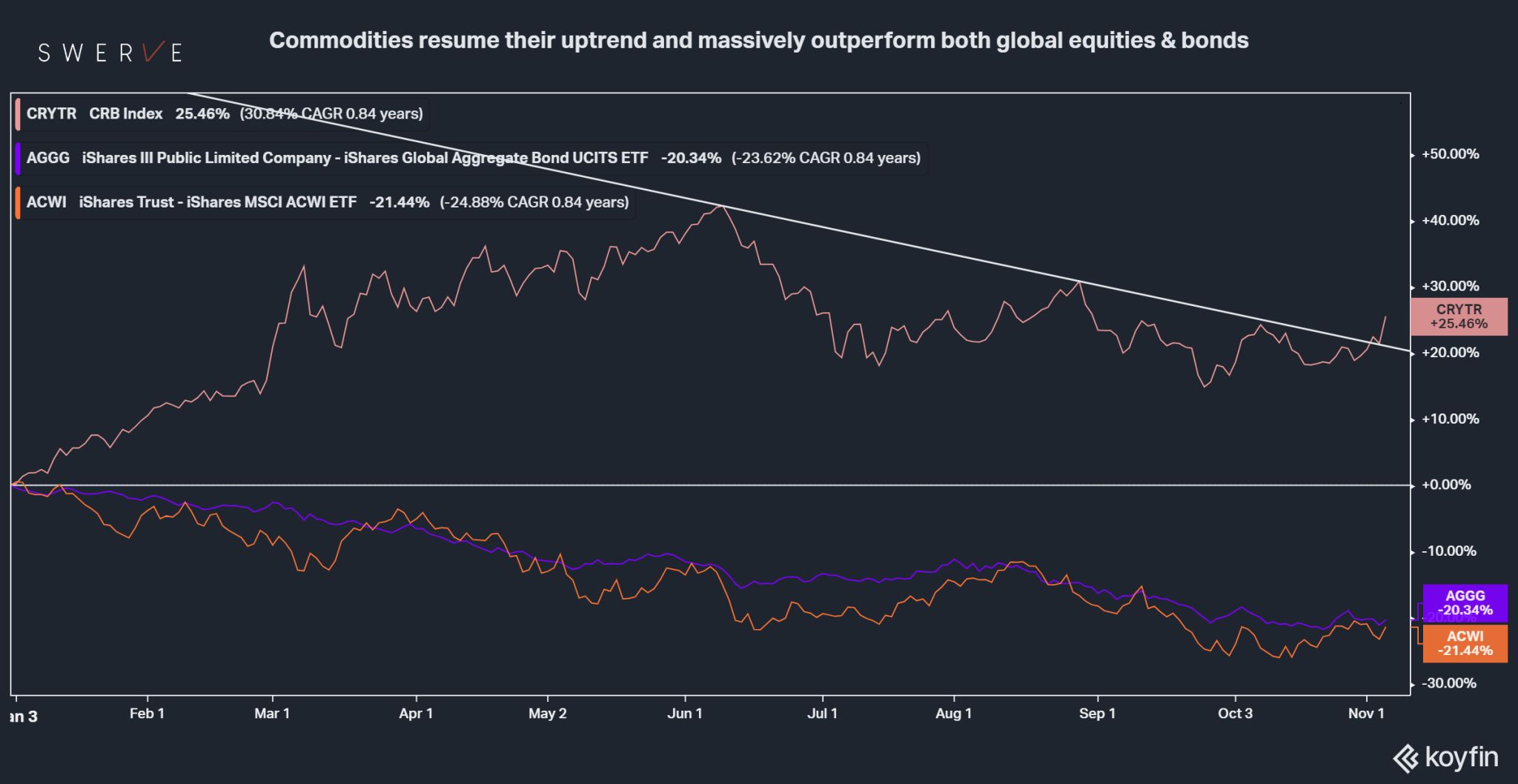

Commodities resume their uptrend

After a period of consolidation #commodities have resumed their uptrend. In one of the most challenging years on record for investors, the sector’s performance YTD is up a stunning 25%, massively outperforming both global equities & bonds (see chart).

It should not come as a surprise. This outcome has been in the cards for two years already and before double digit inflation and Ukraine came to bear (https://bit.ly/3G5pVCj). #energy and #materials are front and center of the macro narrative for this decade; aka “the four “Ds”. #debt , #deglobalization , #demography and #decarbonization will continue to support this trend for the foreseeable future. The likely global recession ahead will only marginally impair demand as fiscal expansion, energy transition and, more importantly, gaps in global supply will continue to keep prices elevated.

Investors are still underexposed to commodities and, in spite of the runup in prices, valuations are still low if compared to other sectors (https://bit.ly/3Ta5UhH). Lastly, because of misguided ESG policies, the considerable cash generated by companies in the sector are largely distributed to shareholders in buybacks and dividends rather than invested in new capacity. Not a secondary matter at a time when markets may trend sideways for years to come.

Disclosure: Hold all assets mentioned. Not investment advice. Do your own research. Twitter @pietroventani for more timely comments and updates