FTX: Here’s why crypto will survive & thrive

There is no question FTX's implosion will carry a long lasting impact. Yet decentralised ledger technology, aka "blockchain", is here to stay.

Last week was arguably the darkest hour todate for #crypto . #ftx , one of the largest and most important companies in the space, imploded as news emerged about objectionable risk-management practices. Crypto critics jubilated and, once more, decreed the end of the road for the nascent industry.

The biggest irony is that FTX’s debacle validates precisely crypto’s main promise: centralized platforms, such as FTX or Celsius, are inherently bound to fail as they are exposed to human mismanagement and corruption. The idea of regulation being able to fix the problem with centralization ignores the very fabric of human history: an endless catalogue of economic and financial crises borne precisely out of the failure of centralized organizations. An example of such failure can be seen playing out in real time today as double digit #inflation is making billions of people poorer courtesy of those centralised institutions whose policies are ultimately responsible for today’s economic conditions.

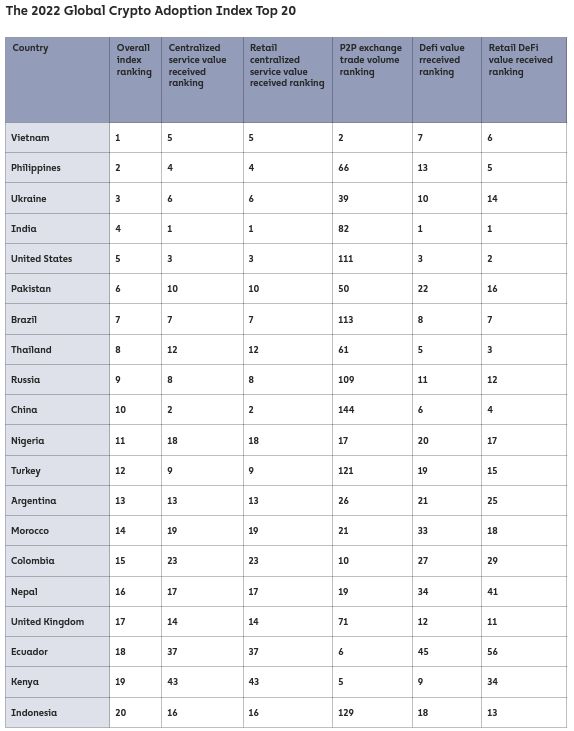

Decentralization and self-custody on the other end, hold the promise of decoupling finance from human malfeasance. Just look at the countries where blockchain platforms are most used: 18 out of the 20 top countries are emerging economies where inflation, corruption and kleptocracies make the most compelling case for decentralised money (see #chainalysis ‘ chart). Hundreds millions people in those countries adopted and self custody digital assets as a way to protect their savings from inflation and corrupt governments.

There is no question that “blood” has been flowing on the streets of crypto and that is precisely why this may be an excellent time to deploy capital in the space. Be very warned however that such investment should be treated as “venture capital”, i.e. very volatile and at risk of extreme loss of capital. Such investment should be articulated over the long term, using careful position sizing and diversified across a well-thought basket of assets.

There is no question FTX’s implosion will carry a long lasting impact. Yet decentralised ledger technology, aka “blockchain”, is here to stay and no number of FTXs is going to change that. The anti-crypto fanatics will be, once more, proven wrong.

Disclosure: Hold all assets mentioned. Not investment advice. Do your own research. Twitter @pietroventani for more timely comments and updates.