Venture Capital flows have collapsed and that is good news for investors

In Q1 2023, VC investment has significantly dropped due to central banks tightening financial conditions and higher interest rates. Yet this year and the next could turn into attractive vintages over the long term.

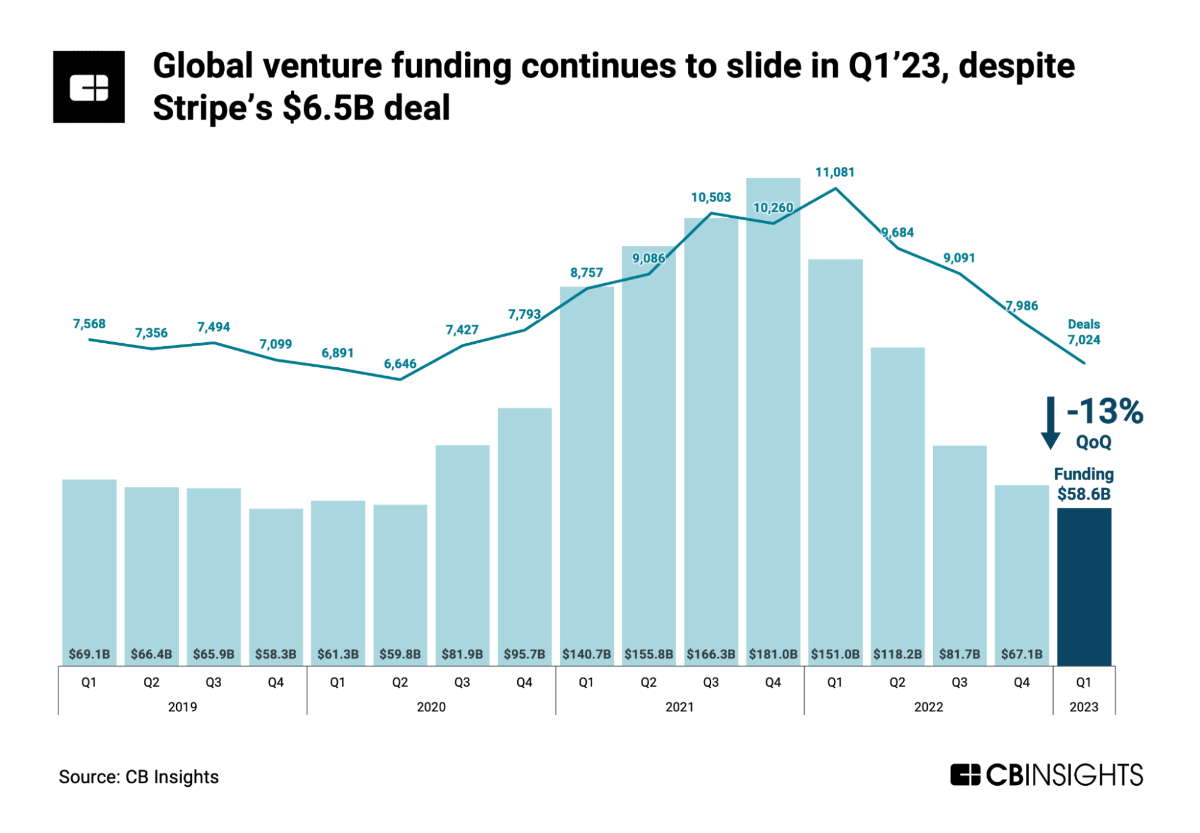

In Q1 2023, Venture Capital (“VC”) investment has significantly dropped due to central banks tightening financial conditions and higher interest rates leading to lower valuations for risk assets, as shown in the chart. However, this year and the next could turn into attractive vintages over the long term.

Valuations have decreased significantly, and competition for deals has softened, resulting in better value for investors and a more competitive environment for early-stage ventures. Surprisingly, tougher times often bring out the best in exceptional entrepreneurs and young companies, leading to excellent returns for capital deployed during recessionary years over the long term.

Another reason for selective investors to consider private markets is that public markets have bid technology company valuations to extreme levels. Although there has been a significant decline over the last 18 months, the forward PE for the largest tech issues remains around 26. It may take years to address the excesses, and investors in many publicly listed companies may need to adjust to far lower returns going forward than they were used to during the age of “free money.”

Technological development is not slowing down. Rather the opposite as advancements in AI and Web3 foreshadow massive value creation already in the next 5 to 10 years. Global VC funds with a 2009-2019 vintage delivered a median net IRR of 22.7%. Granted the dispersion of those returns was extreme, meaning that the best performing funds and investments garnered the bulk of the returns. Therein lies another reason to be “greedy when the others are fearful”; data shows times of market stress are when the biggest returns are often made. One reason is that capital is scarce, relatively less companies get funded and there is less “noise” to separate the wheat from the chaff.

VC investing is notoriously risky, and most early-stage companies never make a profit. However, during times of systemic crisis in traditional asset classes, savvy investors may want to consider a prudently-sized allocation to VC. After all, the future of investing remains investing in the future.