The vast majority of analysts are dismissing de-dollarization: here’s what they are missing

The debate surrounding the de-dollarization has once again gained momentum and the vast majority of commentators dismissing the issue. However, they may be overlooking a few critical developments

The debate surrounding the de-dollarization of the global economy has once again gained momentum, with the vast majority of commentators dismissing the issue. However, they may be overlooking a few critical developments.

In general, money serves two primary functions: as a means of payment and as a store of value. There is no doubt that since the end of World War II, the US dollar (USD) has been the dominant global reserve currency for both purposes. This dominance has been maintained due to several factors, including the size and strength of the US economy, the stability of the US political system, and the liquidity and depth of US financial markets. Nevertheless, emerging cracks are becoming evident in both the payment and store of value aspects.

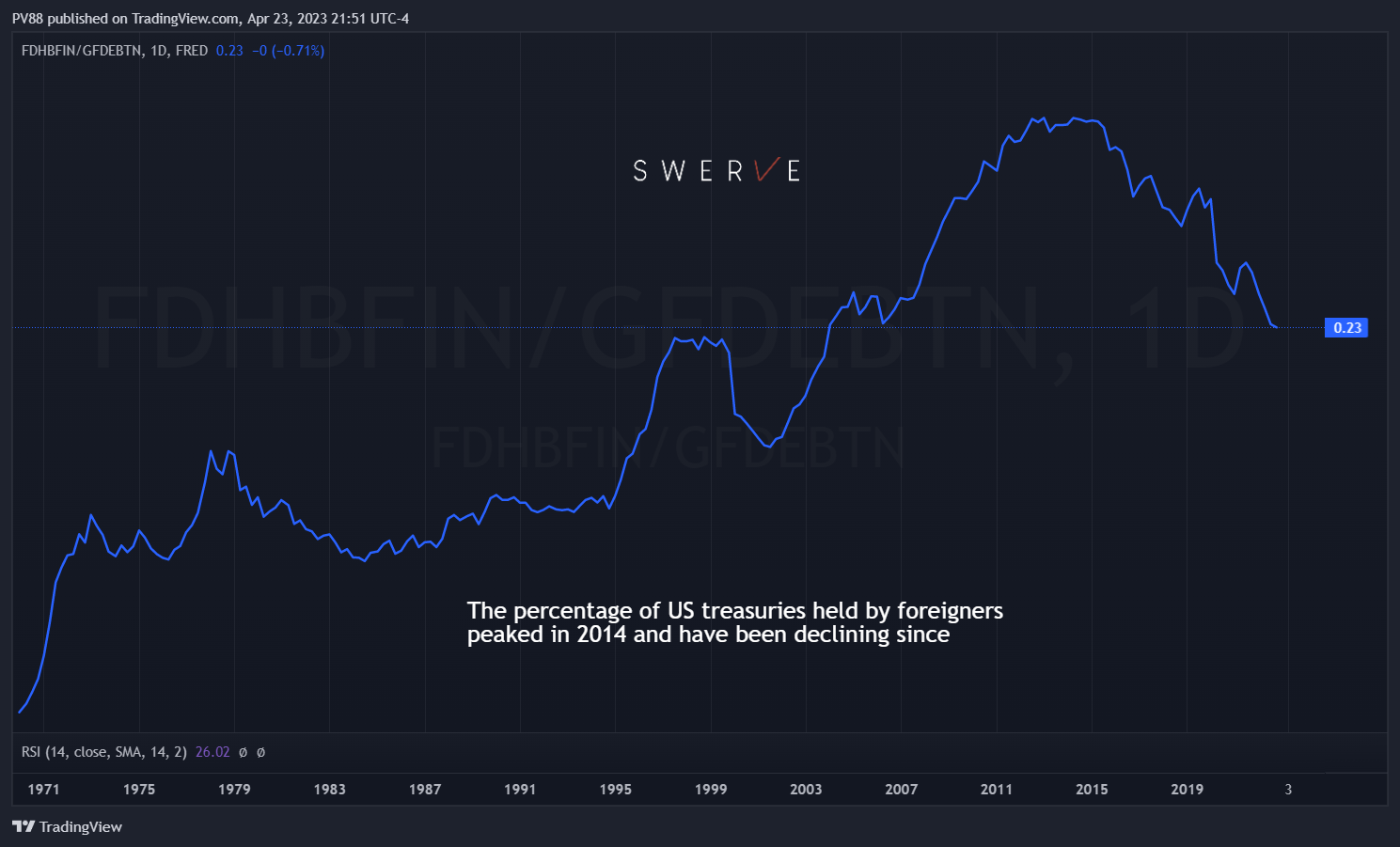

Let’s first examine the USD as a store of value. It is undeniable that, particularly in light of the Ukraine sanctions, an increasing number of countries have started to question the viability of the USD as a reserve asset. After all, what is the purpose of holding USD (or even EUR, for that matter) if the issuer can restrict access to those reserves at any time? Indications of a gradual shift away from the USD are already apparent in central banks’ record purchases of gold last year and the decreasing percentage of US debt held by foreign entities. The latter reached its peak in 2014 and has been on the decline ever since (see chart).

Global payments depend on two major variables: credit markets and trade flows. Regarding credit markets, approximately 60% of the $300 trillion in total global debt is denominated in US dollars (USD), so it is reasonable to assume that the demand for USD to service this debt will remain strong. At least as long participants continue to issue USD-denominated debt. As for the $32 trillion in global trade, estimates suggest that around 80% of it is invoiced in USD. Given that the US only accounts for about 12% of the total, it is reasonable to assume that the currency used to pay for the remaining 88% is a function of those countries’ preferences. The argument here is that the USD is the “cleanest dirty shirt,” meaning there is no other currency that would be preferable to the greenback for trade purposes. This assumption reveals a significant cognitive bias.

The notion that a fiat currency can only be replaced by another fiat currency constitutes a “straw man argument.” It is true that the USD is unlikely to be replaced by the Chinese yuan (RMB) or any other currency in the foreseeable future. However, it doesn’t have to be for the world economy to need less and less dollars. Over the past decade, tokenization technology has made it possible to deploy any asset as a means of payment. Real assets, such as oil, gold, or real estate, can be “monetized” through this technology, effectively serving as a means of payment. This can be viewed as a form of “digital barter” for the modern age. Furthermore, in the era of artificial intelligence, settling transactions between countries doesn’t necessarily require a currency at all, particularly when conducted among countries with balanced current account positions.

The recent discussions among China, India, Brazil, Russia, and the Gulf Cooperation Council countries suggest significant developments are underway. This is further reinforced by the launch of a payment network between Singapore and several countries, including Malaysia, Thailand, and India. Through this network, both individuals and businesses can make payments in other countries using their own currency, as digital settlement eliminates the need for actual money transfers.

At first glance, credit and trade flows may suggest that the USD is securely positioned as the global reserve currency. However, it would be misguided to view the status quo as “inevitable” because no other currency could replace the dollar. What sets the current situation apart from the past is that technology now enables a transition to an entirely new financial system, one that no longer necessitates the adoption of any specific country’s currency as the “global” reserve asset. History demonstrates that global reserve currency status is determined by a complex set of economic, political, and historical factors. Political and fiscal instability, such as a government shutdown or a contentious election, could diminish confidence in the USD and accelerate other countries to explore technology-enabled alternatives.

Indeed, it is highly improbable that any other fiat currency will replace the dollar in the foreseeable future. However, it isn’t necessary for a replacement to occur in order for the US’s “exorbitant privilege” to diminish. Technology already facilitates the diversification away from the USD in both trade flows and reserves. Regarding credit, this same technology enables the utilization of real-world assets, as opposed to fiat-denominated sovereign debt, to drive financial markets. A trend likely to accellerate should US policy continue to undermine confidence in the greenback.

Cognitive biases can be humans’ greatest adversaries. In this case, US policymakers and analysts alike appear to display “anchoring bias,” where they are influenced by their pre-existing knowledge or beliefs, hindering their ability to thoroughly assess or appreciate the disruptive potential of emerging technologies. Investors seeking to safeguard their wealth should strive to avoid falling into the same trap.

Disclosure: Not investment advice. Do your own research. Hold all assets mentioned. Twitter @pietroventani for more timely comments and updates.